Tesla Inc (TSLA)

7 Nov 2020

7 Nov 2020

Tesla Inc. designs, develops, manufactures and markets high-performance, technologically advanced electric cars, solar generation and energy storage products.

| Key Statistics | |||||||

| 52-Week Range | Avg. Daily Vol (3 Mo) | Market Value | Dividend Yield | Float % | Target Price | Consensus Rating (5 strong buy – 1 strong sell) |

Next Earnings Announcement |

| 17.68 – 95.21 | 9,669,706 | 32,622.3 | – | 81.8% | 95.00 | 4.50 | 26/02/2021 |

Its well-known Model S sedan, Model X SUV and Model 3 sedan are among the world’s best-selling electric cars. The cars are technologically advanced, being fuel-efficient, fully electric with rechargeable lithium-ion batteries. Since the late 2016 autopilot, self-driving technology has been available for all models. Tesla’s CEO and founder, Elon Musk, is well known charismatic personality who also runs SpaceX, an aerospace manufacturer, and transportation company, as well as having co-founded PayPal.

The company operates two revenue channels, automotive and energy generation and storage. The automotive channel includes the sale and leasing of vehicles, automotive regulatory credits (sold to other automakers), used car sales, after-sale services, merchandise, and insurance. Energy generation and storage manufacture and sells energy storage products and solar energy systems to residential, commercial, and government customers. Automotive accounts for 96% of sales with energy and storage accounting for the remaining 6%. The United States is by far the most dominant geographical region, accounting for 52% of sales, while China a market of growing importance accounts for 12%. The Netherlands and Norway comprise 6% & 5% of sales with a mixture of other countries totaling the remaining 25%. Tesla began production of vehicles in China in 2019 and the country is viewed as the growth engine for volume with the U.S. market becoming more mature.

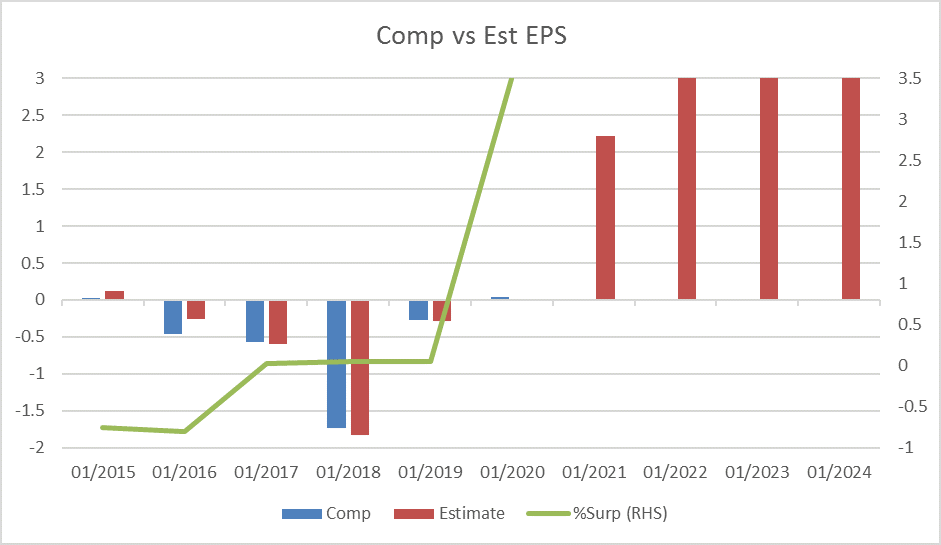

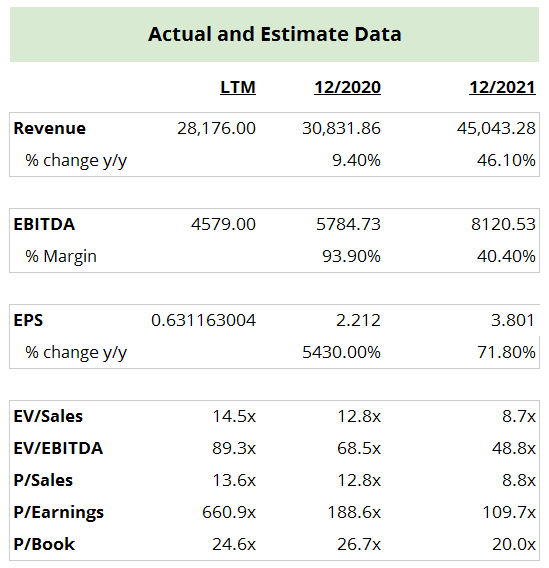

For the financial year ending December 2020 revenue is forecast to rise to $30,831m, up 25% from the prior year, and jump 46% in 2021 to $45,043. Adjusted earnings per share is forecast to rise +400% in 2020 to $2.21 from -$0.72 in 2019 and a further 72% in 2021 to $3.80. This would see the stock trading on forward P/E multiples of 188.6 and 109.7 respectively for 2020 and 2021, compared to an average of 9.5 and 7.3 among peers.

The average target price of analysts covering the stock is $469.50 with 27% of analysts rating the stock as a buy, compared to 32% as a sell and 41% as a hold.

We are glad you liked it

For your convenience, this will appear under your Saved articles in the top menu.