Tesla Inc. (TSLA)

12 Jan 2022

12 Jan 2022

Tesla Inc. designs manufactures and sells high-performance electric vehicles and electric vehicle powertrain components.

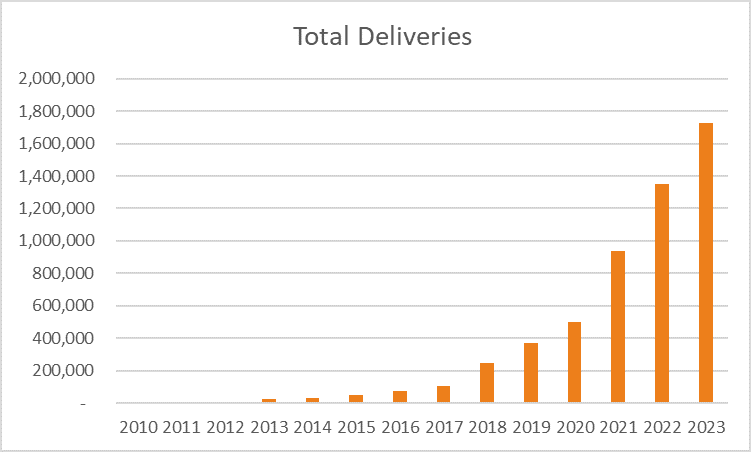

On Tuesday, Tesla Inc. provided a further update on vehicle sales in China, which increased by 34% in November and 348% when compared with a year earlier. Deliveries of vehicles in China also increased to 70,602 up from 31,732 in November. This follows on from an announcement last week of Q4 2021 production and deliveries, where over the quarter more than 305,000 vehicles were produced and over 308,000 delivered compared to 180,570 over the same period a year earlier. Over the calendar year, 936,000 vehicles were delivered, up from 499,550 in 2020 and are expected to rise to 1.344 million in 2022 and 1.601 million in 2023.

Source: Bloomberg

The stock gained +0.59% on Tuesday adding to a 3.13% gain on Monday, helping to offset falls last week. The updates prompted analysts to increase price targets on the stock with Morgan Stanley raising their price target to US$1,300 from US$1,200 and maintaining an overweight recommendation. Meanwhile, Goldman Sachs analysts have named Tesla as their top pick for 2022 with a price target of US$1,200 citing record deliveries, improving margins and ramped-up production in 2022. The 35 analysts who updated their price targets within the past three months have an average price target of US$916.

Tesla is due to announce Q4 2021 earnings on the 27th of January where analysts forecast earnings per share to increase 19% to US$2.23 and revenue to increase 18% to US$16.297 billion from US$13.757 billion in Q3. Tesla remains as a buy recommendation within our U.S. momentum portfolio.

We are glad you liked it

For your convenience, this will appear under your Saved articles in the top menu.