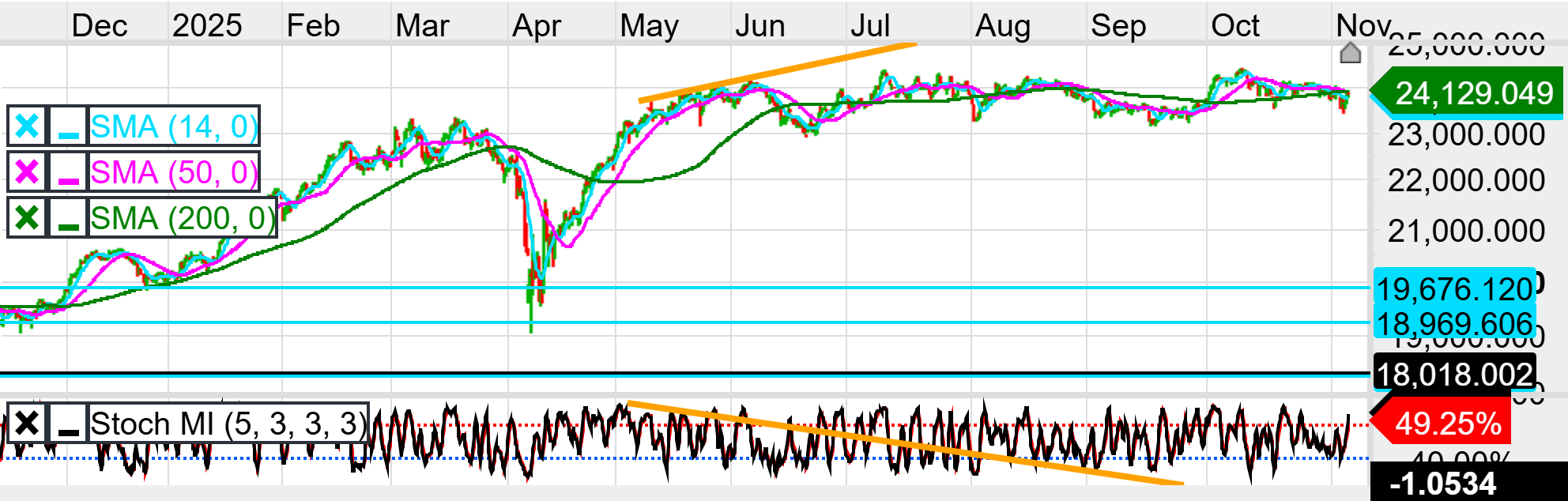

On the daily timeframe the market is trading near the highs (24,100–24,200) but the internals are warning: price made higher highs into mid-year while the Stochastic Momentum Index has made lower highs (see orange divergence line), a classic positive divergence that shows rallies are losing internal momentum and increases the probability of at least a corrective leg. The 200-day SMA (green) sits around 23,380 and remains the primary long-term trend filter — as long as price stays above it the longer-term up structure remains intact, but a clean breakdown below that level would flip the structural bias toward bearish and invite a larger retracement into the blue horizontal support area near 19,676. The 14/50 SMA cluster (shorter moving averages) is currently hugging price and acts as an immediate decision zone: holds and a renewed push above 24,800 would target the 25,500 area; failure to hold that cluster with a close below the 200-day SMA would favour lower targets. Trading plan: for buyers prefer either a confirmed hold and daily reversal off the 200-day SMA or a breakout above 24,800 with SMI turning up; place protective stops below the 200-day SMA for medium-term longs (for example 23,200) or use a tighter stop under the 14/50 band (23,900) for shorter timeframes. For bears, wait for a confirmed daily close back below 23,380 or a failed re-test of 24,800 with momentum still negative before increasing size.

The 4-hour picture is more vulnerable: price has flattened after the mid-year push and the short SMAs are trading close together under the 200-period SMA at times, while the Stochastic MI is trending downward and remains below recent peaks (confirming the daily divergence at a lower resolution). That alignment — corrective price action at/near highs plus falling SMI — signals the current moves are corrective and that the path of least resistance is sideways to lower while momentum fails to expand. Tactical levels: an immediate intraday support band sits near 24,000 (where intraday structure and short SMAs converge); a break below that opens a move toward the daily 200-day 23,380 and then the larger horizontal zone. On the upside, a reclaim and clean 4-hour close above 24,600–24,800 would be needed to relieve short-term bearish risk and allow a retest of recent highs. Trading rules: favour short bias while price remains below the 24,600 area and SMI is positive — consider short entries on weakness or failed retests of the short SMA band with stops above 24,800; for quick longs require a confirmed hold and intraday rebound off 24,000 with SMI turning higher and a stop just below 24,000.

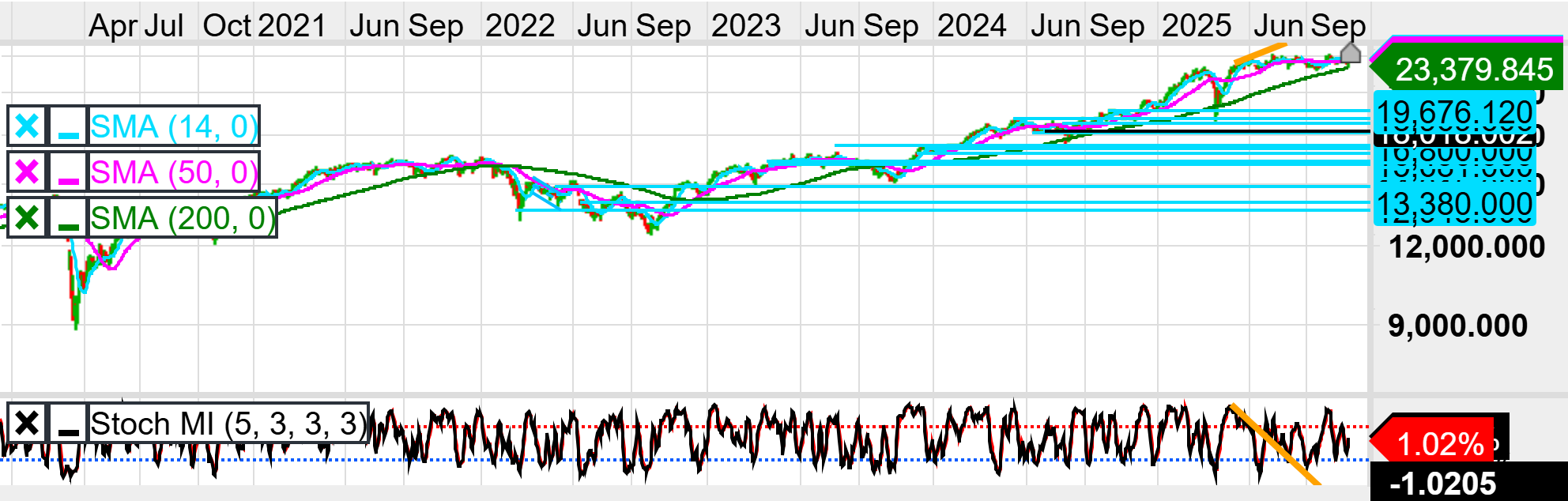

Daily Chart: Longer Term Bias: Neutral