Oracle Corp. (ORCL)

18 Nov 2020

18 Nov 2020

Oracle Corp. (ORCL) supplies software for enterprise information management including databases, relational servers, application development, decision support tools, security, and enterprise business applications. Products are offered across the cloud as well as hardware and services.

| Key Statistics | |||||||

| 52-Week Range | Avg. Daily Vol (3 Mo) | Market Value | Dividend Yield | Float % |

Target Price | Consensus Rating (5 strong buy – 1 strong sell) |

Next Earnings Announcement |

| 39.19 – 62.34 | 12,931,357 | 172,855.10 | 1.7% | 62.0% | 62.81 | 3.62 | 13/12/2021 |

The company’s most well-known product is the Oracle Database, one of the most popular and widely used corporate database offerings. In recent years Oracle has moved towards cloud environments through a series of acquisitions, giving clients the ability to access applications from multiple locations and devices.

ORCL operates across three business segments, cloud and license, hardware, and services. The cloud and license business markets, sells, and delivers applications, platforms, and infrastructure technology and is the primary generator of sales accounting for 83% of sales in 2020. The hardware business segment focus on hardware and hardware-related software offerings including servers, storage solutions, operating systems, management software, hardware services, and support. Hardware sales totaled 9% in 2020. Services offer consulting, support, and education services helping clients maximize their performance with Oracle applications and infrastructure, totaling 8% of sales in 2020. Geographically the Americas are the dominant market totaling 54% of sales followed by Europe, Middle East, and Africa 29%, and Asia Pacific 17% as of Q1 2021.

Oracle recently agree to a 12.5% stake in the video-sharing platform TikTok in which Oracle would serve as TikTok’s secure cloud technology provider with Walmart acquiring a 7.5% stake to provide e-commerce, fulfillment, and payment services. This will be under a new company, TikTok Global that will go public in the next 12 months. The deal signals Oracles intent as a serious contender in cloud infrastructure to compete with heavyweights Microsoft and Amazon, which together account for more than 60% of market share. Oracles core business in databases has helped to shield revenue from the COVID-19 pandemic, with most major business applications built in the pre-cloud era using their databases. This should provide support for revenue and reduce the likelihood of IT budget cuts.

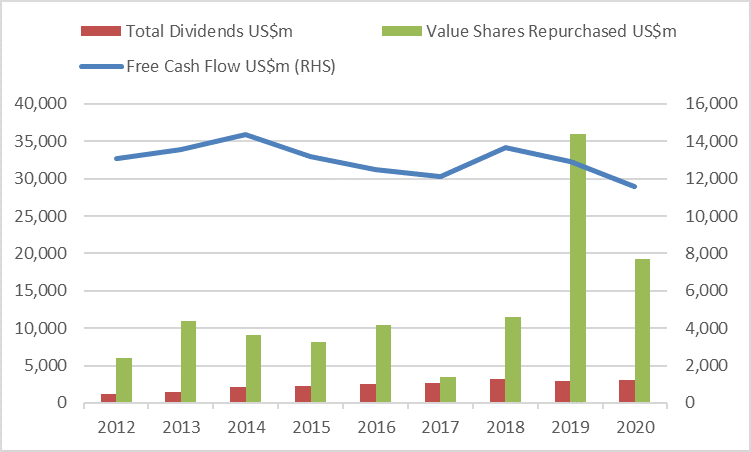

Oracles strong financials and cash flow have allowed the steady purchases and dividends, reducing the number of outstanding shares in the last five years by 30%. With cash flow averaging $12-13 billion, the company is well-positioned to continue dividend pay-outs, which average 30%, even if sales are impacted by the pandemic. In recent years share purchases and dividends have exceeded the free cash flow shown on the chart below, with the difference coming from issuing debt to fund the purchases.

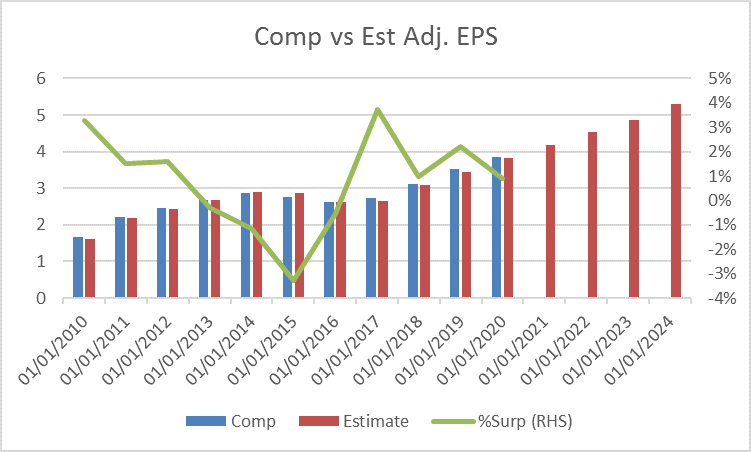

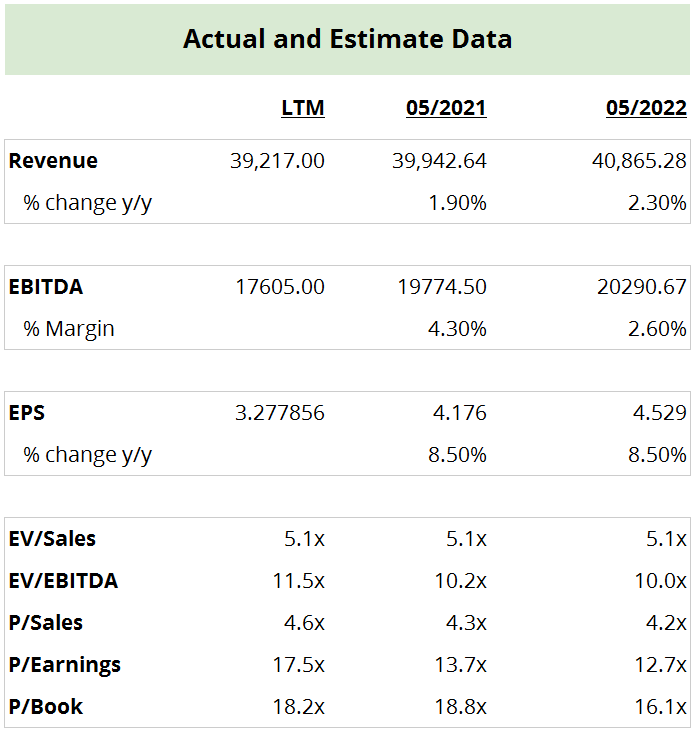

For the financial year ending May 2021 revenue is forecast to rise +1.9% to US$39,942m followed by a +2.3% rise in 2022 to US$40,865m. Adjusted earnings per share is expected to grow at +8.5% for both 2021 and 2022 to US$4.18 and US$4.53 respectively. Based on these figures the stock trades on forwarding P/E multiples of 13.7 and 12.7 respectively, 52% and 60% discounts to peers averages of 28.5 and 31.9 respectively.

The average target price of analysts covering the stock is $62.81 with 36% of analysts rating the stock as a buy, compared to 7% as a sell and 36% as a hold.

We are glad you liked it

For your convenience, this will appear under your Saved articles in the top menu.