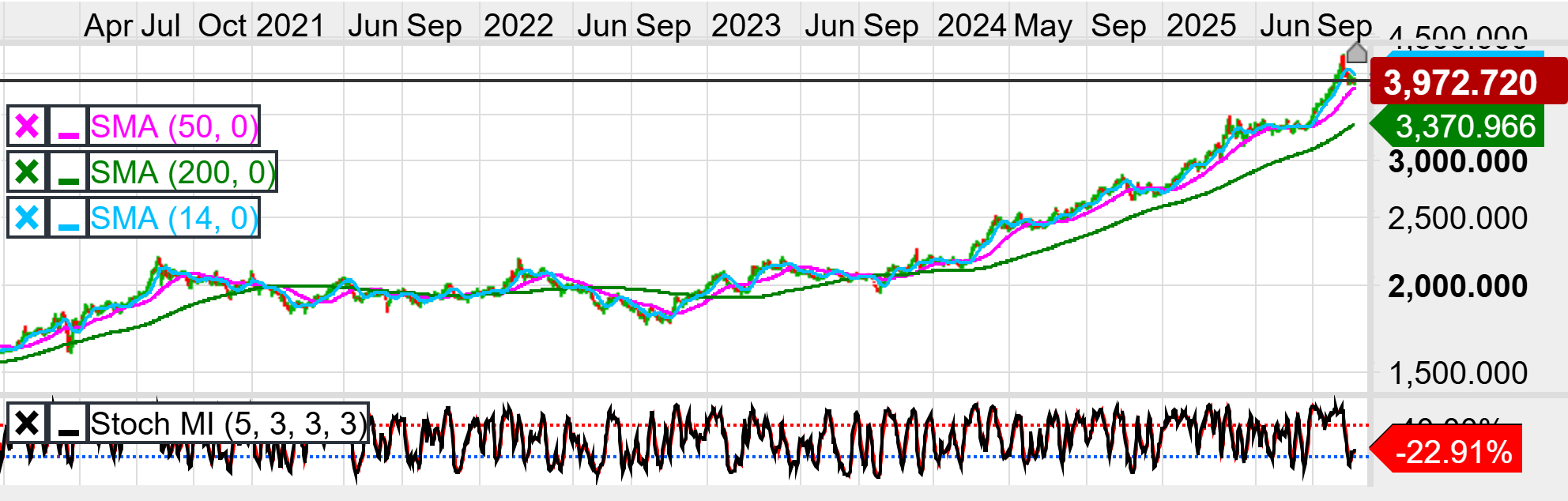

GOLD 4-hourly and daily chart technical view.

Daily Chart: Longer-Term Bias: Neutral

| Resistance |

4,200 then 4,500

|

| Support |

3,970 then 3,371

|

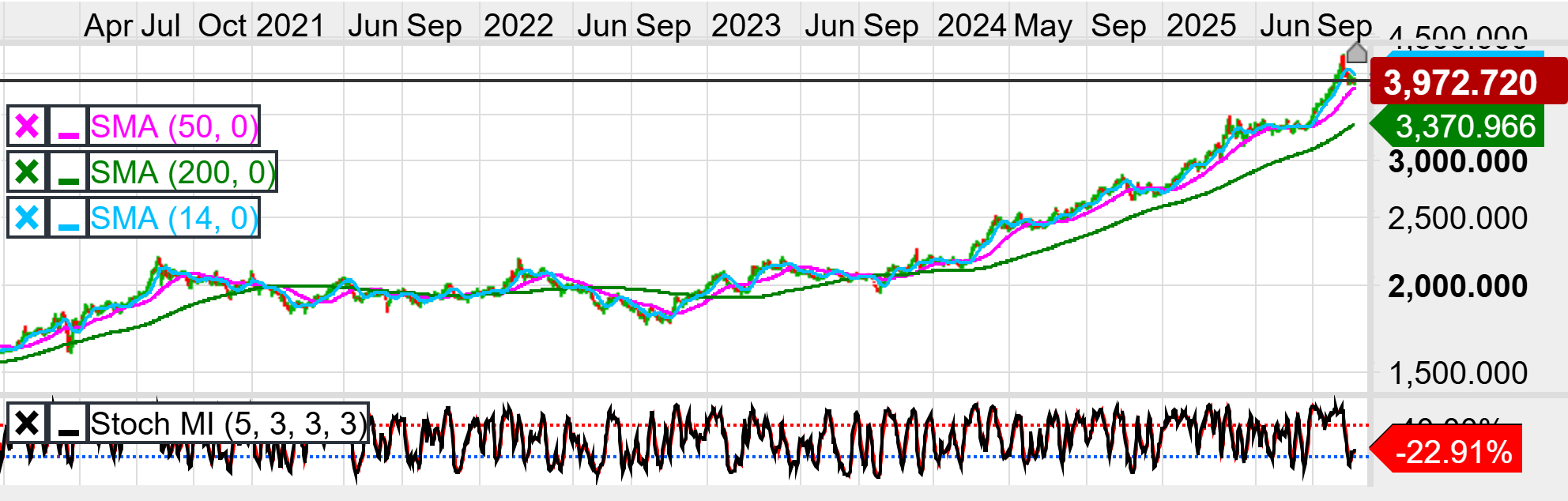

4-Hour Chart: Short-Term Outlook: Neutral-to-Bullish

| Resistance |

4,200 then 4,500

|

| Support |

|

Daily Chart: Longer-Term Bias: Neutral

4 Hour Chart: Short Term Outlook: Neutral-to-Bullish

Thursday 6th November

The daily picture shows the market has pulled back from the recent peak near 4,200 while still sitting comfortably above the 200-day SMA (3,371), which remains the clean longer-term trend anchor and a major structural support. Price is currently sitting around 3,973, roughly at the cluster of the 14- and 50-day SMAs — this cluster often acts as a short-term decision zone (support if buyers defend it, resistance if it fails). Momentum tells a note of caution: the Stochastic Momentum Index on the daily has rolled down into negative territory (the chart shows -22.9%), while price made the most recent high — that negative divergence (price higher, momentum lower) signals the rally’s momentum has waned and increases the chance of a deeper consolidation or corrective leg. Practically, a break back below the short-term SMA cluster would shift the bias toward a corrective phase with the 200-day SMA the key “line in the sand” for longer-term bulls; traders looking to buy should prefer either a confirmed hold and rebound off the SMA cluster or dips toward the 200-day (3,371) for higher-probability entries. Upside targets while above the cluster are the prior high near 4,200 and then the 4,500 area; an appropriate protective stop for medium-term longs would sit below the recent swing low / beneath the SMA cluster (for example 3,800 as a guard) with a more conservative risk manager using a stop below the 200-day SMA.

On the 4-hour timeframe price has stabilised after the pullback and is trading around the same short-term moving average band (14 & 50 SMA) which is now acting as immediate support/resistance depending on price behaviour. The 4-hour Stochastic Momentum Index sits positive (27.1%), and in contrast to the daily it has recovered from prior overbought readings and is rising with price — this confirms short-term bullish momentum and reduces the immediate probability of a sharp reversal. There is no clean bullish breakout yet (price must re-assert above the recent local high near 4,200 for a short-term trend continuation), so the tactical view is neutral-bullish: expect range-bound to mildly bullish moves while price holds above the short-term SMA band, with upside targets at the recent highs (4,200) and the next extension zones (4,320–4,500). If the SMA band and 3,900 support give way on the 4-hour, look for a deeper intraday correction toward 3,700 and ultimately the 200-day 3,371. For short-term longs a reasonable stop is just below the immediate support (for example 3,900) to respect intraday structure; short trades should wait for a break and retest of the SMA band with confirming negative momentum on the 4-hour and the daily before enlarging position size.

Daily Chart: Longer Term Bias: Neutral

4-hour Chart – Short Term Outlook: Neutral-to-Bullish

Wednesday 5th November

Price is trading above the 200-day SMA (the long-term trend line, 3,365 on the chart) and currently sitting around the 50-day/short SMAs, which keeps the longer-term bias constructive; the 200-day SMA is a clear structural support that has contained prior sell-offs and therefore is the primary downside “line in the sand.” The recent run produced a higher high in price while the Stochastic Momentum Index has failed to make a matching new high (the SMI is rolling down from overbought into neutral/oversold bands), which is classic momentum divergence and warns the next leg up may be weaker — that divergence is why I call this bullish but cautious rather than outright aggressive. Practically, a clean close back above the recent swing high / 4,200 level would confirm continuation toward the next round number target near 4,500; alternatively a corrective pullback to the 50-day area (near the current price cluster 3,900) would be the higher-probability buying opportunity for trend followers, with a protective stop under the September low or under the 200-day SMA (3,365) depending on risk tolerance. Because momentum is weakening, keep position sizing light until either a breakout above 4,200 or a disciplined bounce off 3,900 with SMI turning back up.

On the 4-hour chart the market has rolled over from the October peak and SMA alignment has turned less supportive: the short SMAs have crossed back toward the price and the chart shows price trying to find a base at the short-term moving averages after a sharp pullback. The Stochastic Momentum Index on the 4-hour is showing deeper negative readings (into the low/oversold area on the chart) but, crucially, has already trended lower while price chopped higher earlier — another short-term momentum divergence that favours a corrective phase. This produces a near-term bearish bias: a failure to reclaim 4,050 quickly would open a drop to the immediate support cluster around 3,900, and a decisive break below that level would target the stronger structural support near the 200-period/200-day zone (≈3,365). Intraday traders can look for short entries on rallies into 4,050–4,200 with stops a few ticks above those levels; mean-reversion buyers should wait for SMI to turn up and for price to stabilise above the short SMA band (or target a measured bounce from 3,900 with a tight stop below that level).

Tuesday 4th November

The price remains above the long-term 200-day SMA (green) and the faster 50-day/14-day SMAs have been the engine of the recent uptrend, which keeps the longer-term bias constructive; however the chart shows a clear pullback from the recent peak and the Stochastic Momentum Index has retraced from overbought into neutral/softly negative territory, signalling the sharp rally has given up short-term momentum. Importantly, price made a higher high into the recent peak while the SMI stalled (a classic momentum divergence) and that divergence preceded the current retracement — this weakens the immediate upside case until momentum stabilises. Trading plan: the path of least resistance remains upside while price holds above the 200-day SMA (3,359) — a breakout above 4,150 with sustained SMI confirmation would open a run toward 4,300; conversely a close back below the short-term SMA cluster (3,900) would expose the 200-day SMA as the next support. Recommended stops: for new longer-term longs place a stop just below 3,900 (protects against short corrective failure); for swing traders targeting the breakout above 4,150 use a tighter stop beneath the recent local low (≈3,980–3,900) and size accordingly. Explanation: the 200-day SMA is the structural support that separates corrective pullbacks from trend reversals, while the faster SMAs and SMI give early signals of exhaustion or renewal.

On the 4-hour timeframe the price has already pulled back and found intraday support around the short-term SMA band, and the SMI has stabilised and shown a modest recovery from oversold readings — that alignment (price stabilising at the SMA cluster while SMI turns positive) suggests the immediate corrective phase may be ending and a short-term bounce or consolidation is likely. There are signs the intraday momentum is repairing: the SMI no longer confirms the prior overbought extremes and is now tracking price higher, removing the earlier negative divergence seen on the daily; however the slope of the 200-period (on the 4-hour) is still upward so this bounce should be judged as a pullback within a larger uptrend rather than a trend change. Trading plan: short-term buyers can look for a trend-continuation entry on strength above 4,120 with a target into 4,200–4,300, using a stop just below 4,000 (below the SMA cluster) to limit risk; momentum-based shorts should only be considered if the 4-hour SMI rolls back into clearly negative territory and price closes back below 4,000, opening a deeper correction to 3,900. Technical implication: divergence between price and stochastic on higher timeframes warned of the pullback — now, confirmation of renewed upside requires both price to hold the SMA band and the SMI to make higher highs in step with price.

Monday 3rd November

Price is trading around 3,995–3,996, well above the 200-day SMA (≈3,352) and slightly above the 50-day and 14-day SMAs, which confirms the longer-term trend remains bullish. Key resistance: 4,150 then 4,300 — these are the recent swing highs where supply previously emerged and where sellers are likely to reappear if the market extends the rally. Key support: 3,900 (short-term moving average cluster / recent consolidation area) then 3,352 (200-day SMA, structural support). The moving averages’ alignment (price > 14 SMA ≈ 50 SMA > 200 SMA) shows trend strength, but the Stochastic Momentum Index has failed to make a matching new high while price made fresh highs — a classic negative momentum divergence that signals the rally may be losing internal thrust. Implication: trend remains the path of least resistance to the upside, but divergence increases the risk of a corrective leg or a deeper consolidation. Trading recommendation: for trend-following longs, consider targeting the 4,150–4,300 zone with a protective stop below 3,900 (tight tactical) or below 3,350 (definitive structural stop beneath the 200-day SMA). For contrarian/mean-reversion traders, look for a failed re-test of 3,900 with bearish confirmation (SMI rolling down) to consider short/hedge exposure toward the 3,600–3,350 area, keeping stops above the intra-day retest of 4,050.

On the 4-hour timeframe the price has rolled over from the recent high and is trading into the short-term moving-average band (14 and 50 SMAs); the 200-period MA on the 4-hour sits well below and is acting as a longer-term support reference. Immediate resistance: 4,050 then 4,150 (recent intraday swing and the upper boundary of the short-term consolidation). Immediate support: 3,940 (recent local low / short-term MA cluster) then 3,800; a break below 3,800 would open a deeper correction toward the 200-period support zone. The short-term Stochastic Momentum Index sits near neutral/rolling lower after an overbought excursion (the SMI reading moved from overbought back toward 3.5%), and the price-SMI relationship shows momentum peaking earlier than price — this short-term bearish divergence implies exhaustion of the rally and a higher probability of pullback or sideways chop. Trading recommendation: favour short or reduce long exposure into rallies up to 4,050–4,150 with a stop above 4,180–4,200 for tactical shorts; if holding long, use a stop just below 3,940 for a short-term trade and a more conservative stop below 3,800 to protect against a larger intraday reversal.

Friday 31st October

The daily chart shows the market remains above the long-run 200-day SMA (green) so the structural trend is still higher, but the recent sharp rally into the 4,200–4,300 region has rolled over and price is retracing toward the shorter SMAs (14/50). The 50-day (pink) and 14-day (blue) SMAs are converging and have begun to turn down which flags a pause in momentum rather than a full trend break so far; the 200-day SMA around 3,346 is the higher-timeframe “line in the sand” and would be the level that confirms a change to a bearish structural regime if taken out. The Stochastic Momentum Index on the daily is reading deeply into oversold territory (chart marker ≈ −44.26%), which is a classic set-up for a corrective low in a still-uptrending market — divergence is present as price made the recent high while the SMI failed to accelerate higher on the last leg, then the SMI has plunged faster than price on the pullback, signalling exhaustion of the rally and enhancing the probability of at least a bounce back toward the 50-day SMA. Trading suggestions: lean to buying minor pullbacks with a tactical target up to the 4,200–4,350 resistance band while risk managing with stops below the short swing low or a conservative protective stop beneath the 200-day SMA (suggested stop-loss zone 3,300–3,250) to protect against a structural trend reversal.

The 4-hour picture shows the post-rally rollover more clearly: price has pulled back from the intraday peak and is testing the 50/14 SMA area — the shorter SMAs have crossed down through the mid-range and the 200-period 4-hour SMA (roughly in the 3,600–3,900 area depending on exact scale) sits beneath as the next meaningful support. The 4-hour Stochastic Momentum Index is nearer neutral (32.74% on the chart) after the drop, and there is short-term momentum divergence where price made a higher top but the SMI failed to make a proportionately higher reading before the rollover — that warns the short-term upside has been exhausted and increases the likelihood of a multi-session consolidation or deeper retracement. Trading suggestions: avoid fresh long exposure at market unless you can accept a tight stop; consider shorting rallies up into the 4,120–4,200 resistance band with a stop just above the recent intraday high and a target down toward the 3,900 area first and then the 3,600 zone if selling pressure persists. If you prefer the long side, wait for a clean bullish SMI turn from oversold on the 4-hour and a reclaim of the 50-period (14/50) SMA cross before committing — place protective stops below the 3,900 support to respect the short-term risk profile.