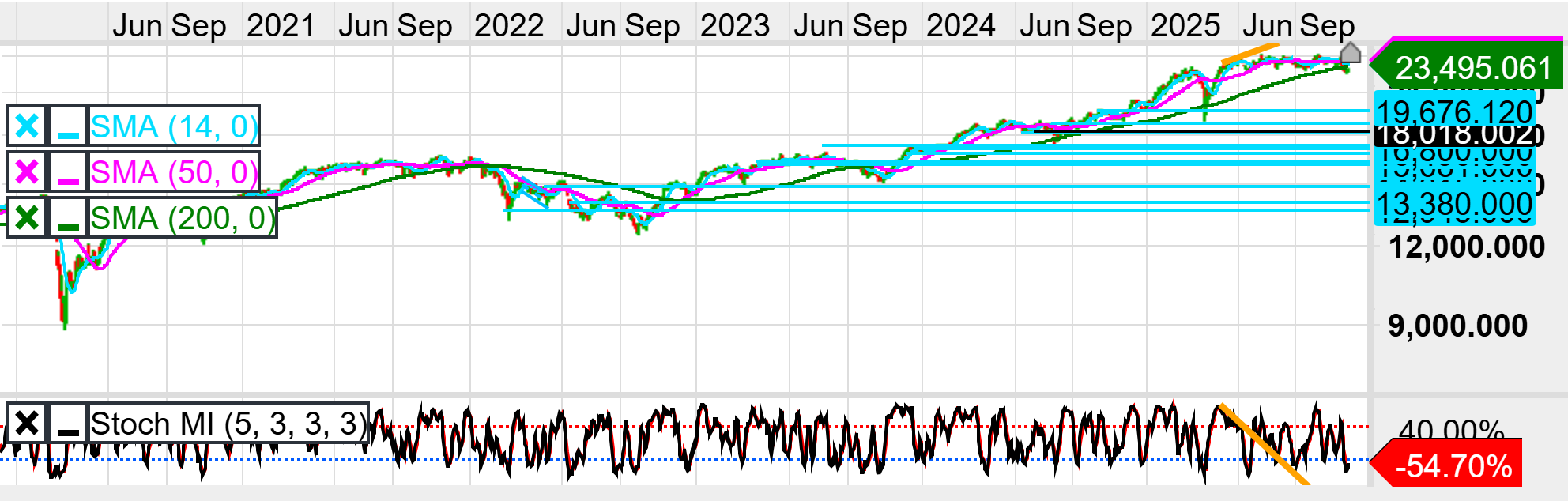

The daily chart shows the DAX losing upward momentum after completing a multi-month advance and now rolling over beneath a cluster of flattening short-term moving averages. Price has pulled back from the 23,495–23,977 region and is now sitting on the 14-day and 50-day SMAs, which have both flattened, signalling a shift from a trending environment into distribution. The 200-day SMA remains upward-sloping, preserving the longer-term trend structure, but the narrowing distance between price and the 200-day SMA suggests waning trend strength. The key development is the clear bearish divergence between price (higher highs into June/July) and the SMI, which has collapsed from overbought conditions to –54.7%, indicating that momentum has deteriorated sharply despite price holding near highs. This divergence warns of a deeper corrective phase. Immediate support sits at 23,000, aligned with prior swing lows and dynamic SMA support; a break below this level exposes a full retracement toward 19,676, the major structural support zone spanning 2023–2024 consolidation. Upside recovery requires a decisive move back above 24,000, with trend continuation only confirmed above 24,350. For risk management, long positions should carry a stop below 23,000, as a breakdown here validates the bearish divergence and signals a transition into a deeper decline.

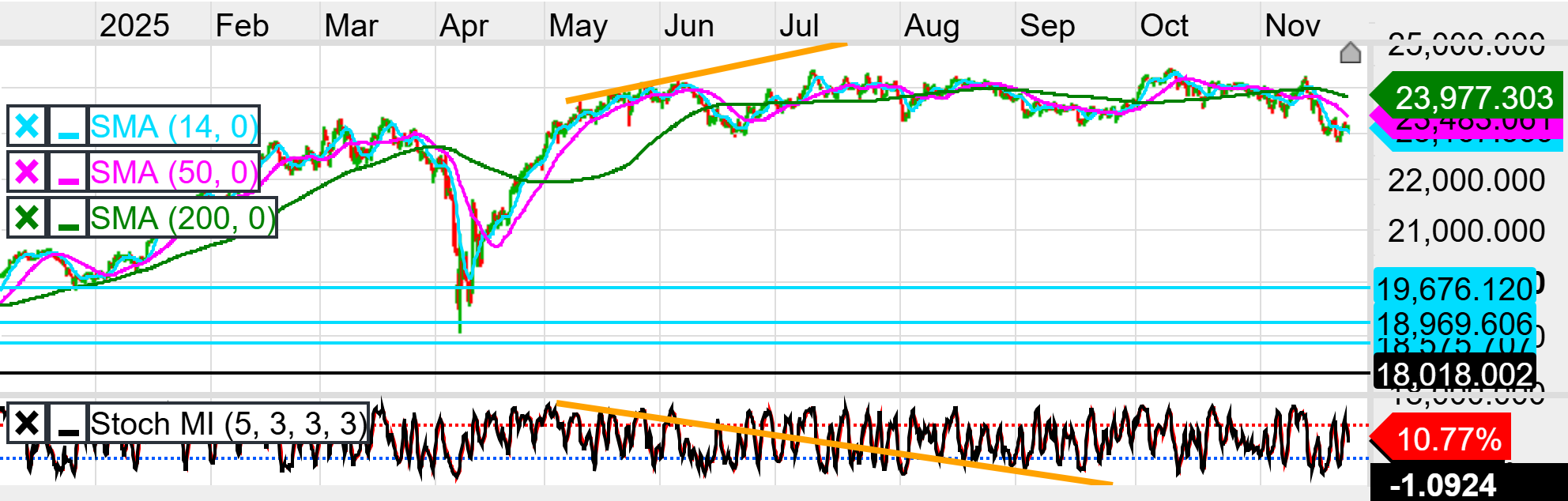

The 4-hour chart reinforces a bearish short-term bias, with price rolling beneath the 14-period and 50-period SMAs, both of which are now sloping downward and acting as dynamic resistance. The 200-period SMA remains upward-sloping but has begun to flatten, indicating that the prior medium-term uptrend is losing velocity. The chart shows a clean bearish divergence: price made a marginal higher high in June/July while the SMI trended sharply downward, falling to 10.77% and then turning lower again after a weak rebound—an indication that the internal momentum structure has broken. This divergence is now playing out as price softens beneath the short-term averages. Immediate support is at 23,200, which aligns with the most recent swing lows, but a break below this level likely triggers a move toward 23,000, a major psychological and structural support zone. To negate the bearish structure, price must reclaim 23,700, and only a sustained close above 24,000 would re-establish bullish momentum. For short-term positioning, stops should sit above 23,700, as a reclaim of that level would invalidate the immediate bearish posture and reset the risk/reward structure.

Daily Chart: Longer Term Bias: Neutral-to-Bearish